Cash rules everything around me

This is the 3rd essay in a 5-part series on funding models for the creator economy

- Funding the creator economy

- Avoiding the venture trap

- Cash rules everything around me

- Shared income and bespoke finance

- NFTs, $GME, and the crowdfunded Cambrian explosion

Most of the time when I see a pre-revenue company trying to fundraise, my first question to them is why they aren't trying to get money from customers first. If you are developing life extension drugs or a social network or rockets, then you are probably going to need upfront capital before you have revenue. For almost everyone else, the easiest way to learn if your idea is working is to ask people to pay for it.

The best form of funding is revenue from customers, because revenue can be converted into any other funding model (or none at all!). Revenue provides you freedom, optionality, and control. My startup, Creator Cabins, is self-funded. Maybe I will raise venture capital someday to accelerate growth. Maybe I never will. Because my wife and I own 100% of the company, it's up to us.

It is easier than ever to make a landing page, hack together some no-code tools, or start a newsletter. In 1999, you had to literally buy servers, stick them in your closet, and then be prepared to do a lot of programming and computer networking if you wanted to set up a website. Now, you can do it for free in under an hour. This is what Tyler Tringas calls the Peace Dividends of the SaaS Wars:

- Quick start open-source development frameworks (Ruby on Rails, Laravel)

- Scaleable server infrastructure (Heroku, AWS)

- A full-stack suite of tools for the basic operations of software businesses (SaaS for help desk, email & social media marketing, FAQ, billing, analytics)

- Free distribution networks from piggy-backing on fast-growing app stores and platforms

- No-code platforms allowing entrepreneurs to reduce their engineering costs to get to market (Zapier, Webflow, Airtable, Shopify)

- Battle-tested methodologies for finding and validating businesses (Lean Startup, Traction)

In Tyler's words: "The net effect is that it’s easier, cheaper, and faster than ever for a solo founder or small team to get a software product live and creating real value for customers with little to no outside investment."

It's not just that it's cheap and easy to get something live quickly—it's also a better way to build a business. By co-creating an audience-first product you can find product market fit along with your customers. Together, you build a community and a product. The two become deeply intertwined and each makes the other more valuable.

The best part is: once you have significant revenue, investors will be tripping over themselves to give you money on much better terms.

Revenue advances

Revenue immediately unlocks other funding models that are directly tied to how much cash your company can produce. If you need more cash now, you can get a revenue advance, which is essentially a loan secured by future revenue:

- Payment vendors like Stripe and Square have access to lots of data about how much money businesses are making. They've put this data to use to develop easier, faster, more automated lending options than banks can manage.

- Pipe, which recently closed a large funding round, takes a similar approach by integrating with a company's accounting, payment processing, and banking systems and then automatically turns that into loans that get sold on a marketplace.

I expect this model to quickly extend to the entire stack of creator economies.

When I led the Shoppers product team at Instacart, I learned that people became Shoppers for two primary reasons: flexibility and liquidity. Being a Shopper gave people control over their time and the ability to earn money fast. One of the most universally enjoyed features of the gig economy is the ability to work when you want and then cash out your earnings immediately.

Uber already has a debit card for Drivers. It is a natural extension for gig companies to start providing banking services for gig workers. Much like Square and Stripe, gig companies know a lot about people's earning habits on their platforms. They can forecast future income accurately and provide much lower-risk, cheaper loan services than are otherwise available. The payday loan industry offers predatory high rates to people without other options. The gig economy could provide a more equitable path to helping people cover short-term expenses.

But this won't stop with the gig economy. This trend shows that any company that controls monetary transactions for you also knows enough about your revenue to offer you attractive loans. You could imagine someone offering revenue advances to YouTubers by analyzing their subscribers and views and predicting their ad revenue.

Crowdfunding

Another way to get revenue now is to ask people to pre-order your product. This was the innovation of crowdfunding platforms: gather revenue now and use it to develop your product. For most of the last decade, crowdfunding generally meant either:

- Project-oriented one-off raises on platforms like Kickstarter

- Generating recurring fan revenue from platforms like Patreon

These platforms have helped revive Kevin Kelley's vision of 1,000 True Fans, where a small number of people can create meaningful income for independent online creators. There are plenty of good guides for getting up and running on these platforms. Here are a few:

As we'll explore in the last essay in this series, crowdfunding is where the difference between revenue and funding starts to get blurry. Crowdfunding is eroding the distinction between customers buying your product and investors investing in your business.

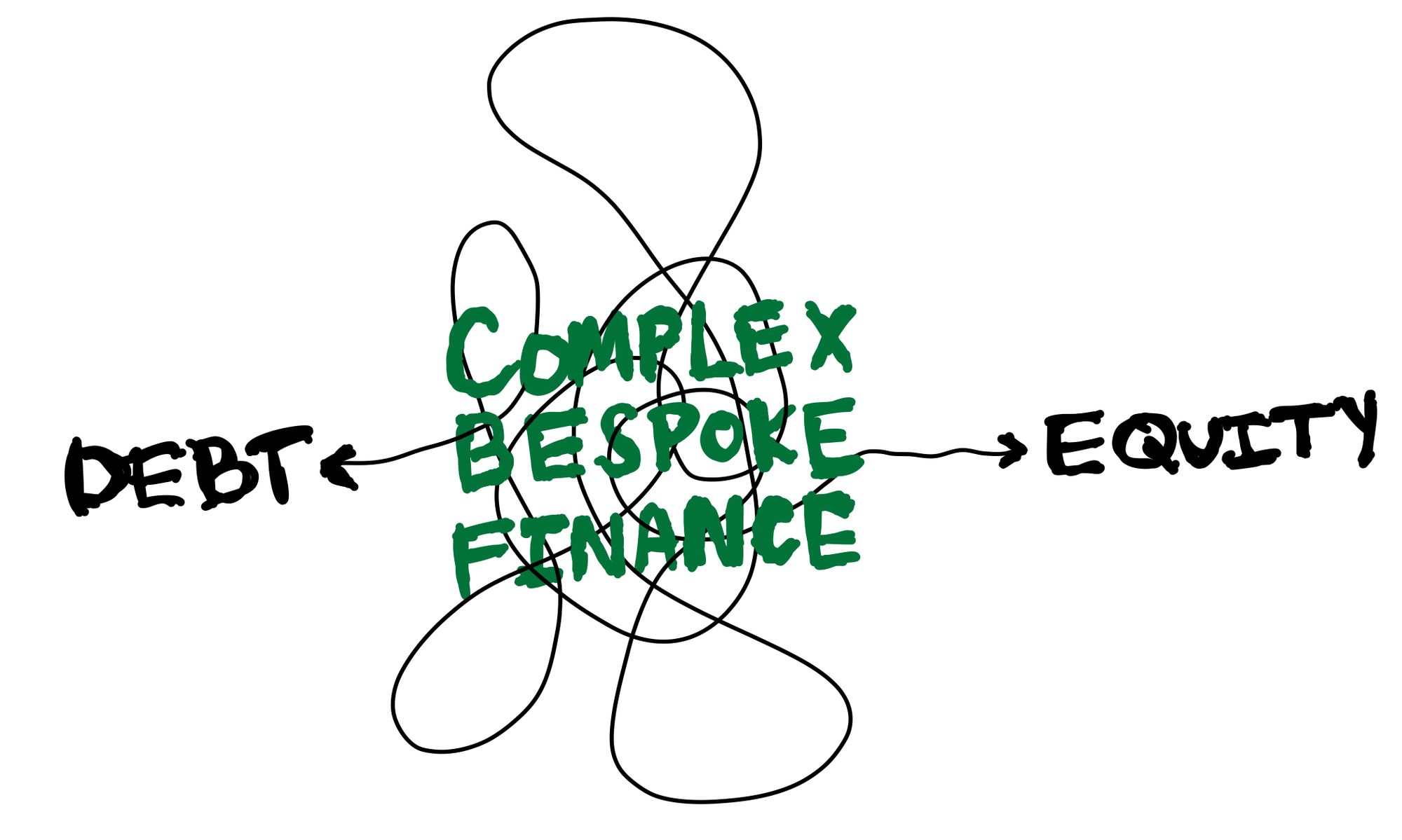

From here, we'll explore how complex bespoke finance and weird Web 3.0 technologies are creating new funding models for online creators. In the remaining two essays in this series, let me show you how deep the rabbit hole goes...