Multiplayer marketplaces

Last Wednesday at 4:00am, bleary-eyed and freshly caffeinated, I watched in awe as a dozen people, many who had never met before, descended on my property and worked together to build something that may be there for hundreds of years.

We are building a new Creator Cabin and I've been getting a crash-course in construction. I'm learning a lot about the invisible physical infrastructure that surrounds us: electric lines, plumbing, septic systems. I'm also learning about the construction industry, which I think is a compelling operating model for the future of work. That's because the future of work is the gig, and construction is the original gig economy.

I want to build a house, so I hired a contractor to build a foundation for it to sit on. He then turned around and hired subcontractors: one to bring trucks of concrete to the site, another to pump the concrete into the forms, a third to build the forms and shape the concrete into a foundation. There may have been more companies involved, I don't even know. All I know is that I hired a guy to deliver a completed foundation and he handled it from there.

And that’s just the actual foundation contractor. Before we poured the foundation, the electrician had to put a grounding wire in the form, the house builder had to coordinate extensively on the foundation design, the septic guy had to get his pipes in place. It required massive coordination between people that may never meet, rely heavily on each other’s work, and are financially incentivized to make edge cases someone else’s problem. A modern multiplayer market miracle.

Market coordination

Markets are systems for coordinating humans to produce things. What makes them different from other coordination systems, like companies or tribes or countries, is that markets can do it without anyone in charge. They produce novel and unpredictable outcomes precisely because no one planned them.

A market is able to pull off this magic trick by creating the conditions for coordination among independent self-interested actors. The platonic ideal of this relies on "perfect information": all consumers and producers having perfect and instantaneous knowledge of all market prices, their own utility, and own cost functions. Economics relies on this sort of absurd, impractical assumption as a given in order to make any useful calculations. That's why economists don't have a good track record at predicting things in the real world.

But there's a curious thing happening right now: just as we are waking up to the fact that economist's physics envy hasn't made for good science, computers and the internet have created something that much more closely resembles the platonic ideal of markets that economists live within. Markets function well when there is lots of available information and low transaction costs—when everyone knows everything and can interact with anyone.

In other words, the internet is made for markets.

Markets rule everything around me

It’s no surprise that in this low transaction cost environment, many of the fastest growing, biggest emerging companies are marketplaces: Uber, Lyft, Airbnb, Instacart, Doordash. They build software to reduce transaction costs and leave the physical infrastructure up to the supply side. Stratechery popularized the term Aggregation Theory to describe this dynamic:

The value chain for any given consumer market is divided into three parts: suppliers, distributors, and consumers/users. The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution. In the pre-Internet era the latter depended on controlling distribution.

The fundamental disruption of the Internet has been to turn this dynamic on its head. First, the Internet has made distribution (of digital goods) free, neutralizing the advantage that pre-Internet distributors leveraged to integrate with suppliers. Secondly, the Internet has made transaction costs zero, making it viable for a distributor to integrate forward with end users/consumers at scale.

When I first read about Aggregation Theory, I didn’t grok the importance of what Ben Thompson was saying. The takeaway here is not just that the points of integration and modularization have changed, it’s that the integrated value capture sits right in the middle, between supply and demand—it’s a marketplace!

What a business model: building software to do what the internet does best—reducing transaction costs—is so valuable that you can attract independent supply and demand without the challenges of vertically integrating supply. This marketplace mentality has so thoroughly encapsulated the Silicon Valley ethos over the past decade that people forget businesses can be built any other way. When I was running product interviews at Instacart, my favorite questions were always something along the lines of:

“Imagine you want to start a business in X industry. How would you do it?”

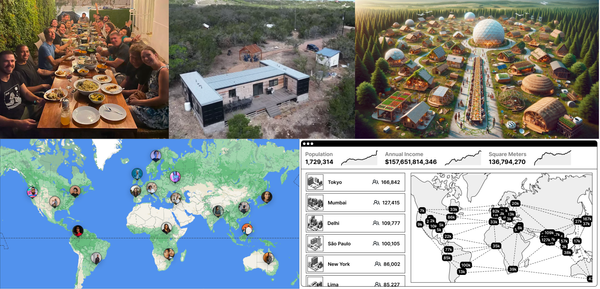

Without skipping a beat or even considering the possibility of alternative approaches, I watched hundreds of product managers dive into designing a marketplace. These PMs were taking their cues from the startup landscape, where there was now a marketplace for everything from dog walking to sneakers:

In brands we trust

You hear marketplaces like Uber and Airbnb talking a lot about trust. Airbnb claims they are a “business fueled by trust”. Uber faced an existential crisis of trust that resulted in booting the founding CEO and spending ungodly amounts of money on a PR campaign and ads assuring us that we could trust them.

Marketplaces sell trust because they don’t control a vertically integrated supply side, but consumers still expect brands to deliver on their promises. When you stay at a Marriott, you expect a certain level of quality and customer service because that's what you always get when you stay at a Marriott. Most hotel chains are actually franchises, owned and operated independently. Even though they don’t own most of their hotel properties, Marriott is worth $48B because they have earned a brand consumers trust by enforcing detailed control over how customers experience their brand standards at franchisee’s hotels.

But marketplace platforms like Airbnb not only don't own the inventory, they don't have the ability to enforce detailed brand standards. The marketplace platforms have outsourced their brand enforcement back to customers and the market. This is why the Airbnb review process is so cumbersome—you are the enforcement mechanism for the brand:

Trust is the bottleneck of marketplaces. The ability to define and enforce brand standards in a world of modularized, independent supply has kept marketplaces fragmented and specialized. It has also led to increasingly managed marketplaces, where the ideal of frictionless transactions is replaced with a centralized authority that starts to look like a traditional supply-side integrated company:

From managed to multiplayer marketplaces

As Netscape cofounder Jim Barksdale said, there are only two ways to make money: bundling and unbundling. Marketplaces of the past decade have unbundled atomic units of fungible goods and labor. They have massively reduced transaction costs for single transactions within a specific vertical. One ride. One delivery. One vacation rental.

As marketplaces chase trust by specializing into more centrally managed experiences, I wonder what the next wave of decentralized markets looks like. For the past decade, companies have been building marketplaces. Now, how can we use labor marketplaces to assemble just-in-time companies? How do we bring together these building blocks into larger-scale human coordination?

Construction, with its loose network of subcontractors, points the way. If dozens of people using phone calls and informal relationships of trust can come together to build physical infrastructure, surely we can do better with software and the internet.

Nadia Eghbal’s Working in Public shows how open source software has discovered some mechanisms for managing open-contribution networks. Cooperatives like Ampled, built by a loosely coordinated army of independent engineers, designers, product people, and marketers provide another interesting example of where we may be headed.

We will also need new ways of managing decentralized trust and incentives to achieve multiplayer marketplace coordination. Decentralized autonomous organizations built using smart contracts on blockchains are a tantalizing vision of the future.

As the nature of the firm changes to reflect the reality of decreasing transaction costs, I believe we are just beginning to see the implications of small groups of independent actors self-organizing to solve problems. As we learn how to navigate trust and coordination problems in these multiplayer marketplaces, we will unlock more human potential for creation in the 21st century than corporations did in the 20th century.